Block66 - Better Mortgages Powered by Blockchain Technology

- Get link

- X

- Other Apps

ICO market is nowadays pretty similar to the Wild West during the gold rush period. It is possible to earn money very quickly, sometimes even good money, but you have to find a perfect spot, or in this case, a good project to invest. Common thing to the Wild West? No guaranties and almost no law. It is pretty easy to find bad cowboys which are going to promise you golden mountains to steal your last piece of bread. So in all this mess, if you want to find your gold nugget, you can trust just your own brain composites.

So did I and during my research I found the project in which I really put my faith: BLOCK 66. Very likely you haven’t heard about them, project is made by great team members. Nevertheless, guys have an advantage, many other teams does not: already existing product made on a very perspective field. But these are not all pluses I found in this project. Below you can read the analysis and decide on your own, do you want to send some pennies to the pot.

Block66 is building a new blockchain-enabled marketplace for mortgages. Institutional and private lenders can use the service to offer loans to a wide range of borrowers, introduced by Block66 broker partners. Through the practical use of smart contracts, loans can be taken from origination to facilitation, quickly and efficiently. All loans are also represented as tradable tokenized securities, providing a liquidity mechanism as standard. The ability to trade fractions of loans, and reduced order and issuing fees makes investing more inclusive, providing an attractive investment vehicle for all manner of investors. Block66 infrastructure will be implemented as a decentralized application (dApp), and run on the Ethereum network. Brokers will be able to list clients as lending opportunities on the platform, after being thoroughly vetted by Block66 through proof of residence, credit reports, license verification, and criminal record checks. Proprietary software, as well as a network of partners, will be used for this purpose. Based on a personal risk/reward ratio, lenders can then select an investment from the offered mortgages to add to their portfolio.

PROBLEM

The mortgage market in the USA is $9.9 trillion dollars, $32.9 trillion worldwide, and growing but risk averse institutions are reluctant to lend to many creditworthy consumers. Willing small lenders struggle to enter the space at scale. Existing processes and technology are cumbersome and siloed, compounding the problem for borrowers.

SOLUTION BLOCK66 OFFERS

Block66 streamlines the entire mortgage software and operations stack. For brokers, a one-stop-shop, including credit scoring, property appraisals and lender matching. For lenders of all sizes, a sustainable loan pipeline, auditing tool and mortgage securitization platform. For borrowers, a quick, hassle-free way to access the best credit opportunities.

BENEFITS OF THE BLOCK66 PLATFORM

Mortgages provided by Block66 platform would be reflected both on the blockchain and the physical world via a Digital Trust Fund (DTF). There would be a provision made for the trade of proof of loan token s (POL) later in the future carried out on an exchange platform designed specifically for this purpose by virtue of a proprietary exchange.

Block66 would start by focusing on helping serve borrowers in good/prime credit bands.

Block66 would provide legal assistance across various geographies incase a borrower defaults.

To ensure the block66 platform is run efficiently areas that need to be checked by humans would be worked upon by human while using blockchain technology, a set of digital underwriters would be put in place to validate documents

By using blockchain technology to ensure data authenticity and security, Block66 would go a long way protecting against any form of mortgage fraud. Most mortgage fraud is carried out either by the borrower or broker and is sometimes missed by lenders or underwriters because of the massive numbers of documents they are handling. Block66 would prevent this problem by flagging controversial articles for review by writers and lenders making it easy to check fraud.

All lenders on the Block66 platform would provide their requirements for lending upfront, making it easy for brokers to submit their application. Numerous lending offers would be available on the Block66 platform for both borrowers and brokers to select the best deals.

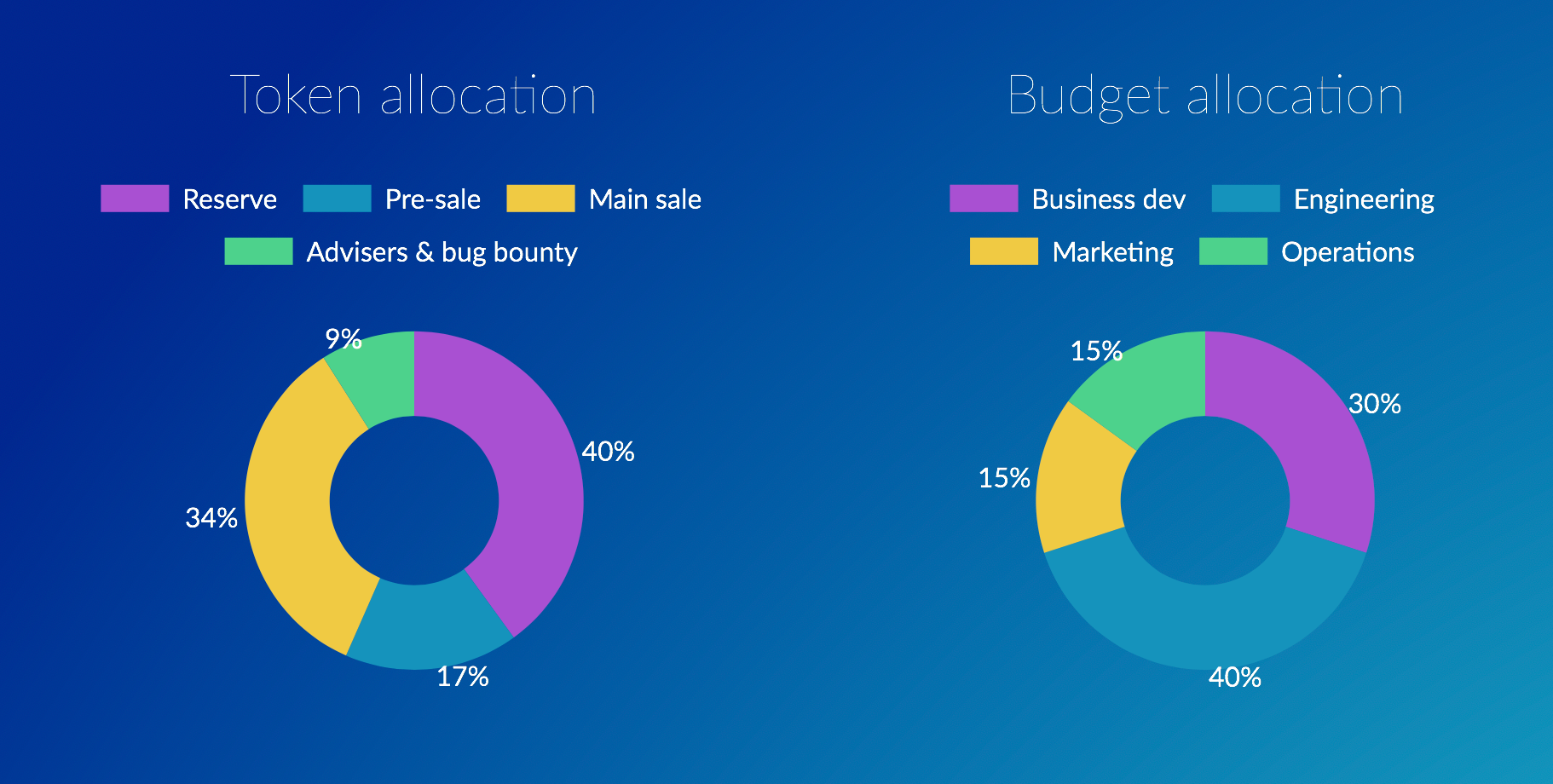

TOKEN AND ICO DETAILS

Symbol - B66

PreICO - Price 1 B66 = 0.10 USD

Price - 1 B66 = 0.15 USD

Platform - Ethereum

Accepting - ETH

Soft cap - 3,000,000 USD

Hard cap - 20,750,000 USD

You can get whitelisted here: http://eepurl.com/drDUyz

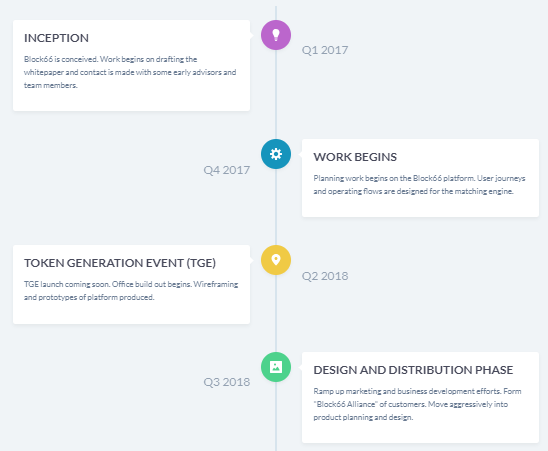

ROADMAP AND DEVELOPMENT PERSPECTIVE

Above you can see the roadmap — how the team sees their nearest and long-term future.

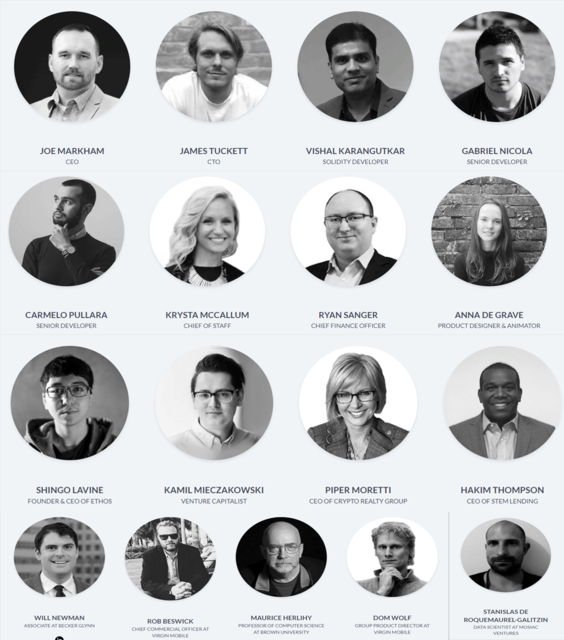

TEAM MEMBERS AND ADVISORY MEMBERS TO THE PROJECT

Team seems to be the strongest part of this project. It consists of innovative and talented people. Of course I cannot complain if we talk about their professional level, guys indeed are experts on their field.

BLOCK66 PARTNERS

Block66 is on a mission to shake up the mortgage lending landscape by building the world’s first blockchain enabled mortgage lending network. The network will span borders, connecting private and institutional lenders with borrowers worldwide. All mortgages will be issued and managed on the blockchain. Be a part of this tremendous project and follow these links for more information;

Website - https://block66.io

Facebook - https://www.facebook.com/Block66Official

Twitter - https://twitter.com/Block66_io

LinkedIn - https://www.linkedin.com/company/block66/

Reddit - https://www.reddit.com/r/Block66/

Medium - https://medium.com/@block66

Author

nugezmils

nugezmils

BITCOINTALK PROFILE

https://bitcointalk.org/index.php?action=profile;u=1729621

https://bitcointalk.org/index.php?action=profile;u=1729621

- Get link

- X

- Other Apps

Comments

Post a Comment